Nigel Baptiste, President and Chief Executive Officer of Republic Financial Holdings Limited, has stated that financing a ‘Green Caribbean’ is indeed achievable—but will require sustained effort and a multi-faceted strategy.

While the region has expressed strong interest in transitioning to a green economy, challenges persist in closing the investment gap and securing adequate climate finance.

“It is feasible to finance a ‘Green Caribbean,’ but it requires a multi-pronged approach involving various financing mechanisms and a strong commitment from both public and private sectors. While the region faces challenges like high debt levels and limited access to traditional financing, innovative solutions and international support are increasingly available,” Baptiste said.

As global warming accelerates and climate-related weather events grow more frequent and intense, it has become imperative to restructure production and consumption patterns. This transformation promotes alignment among the triple goals of environmental, economic, and social sustainability.

“The challenge of climate change has given rise to a variety of initiatives aimed at the ‘greening of the global economy,’ that is, the creation of an economy which the planet can sustain indefinitely,” Baptiste added.

To effectively respond to the realities of climate change, the Caribbean requires major investment in both climate adaptation and mitigation. This includes upgrading infrastructure, scaling renewable energy solutions, and advancing sustainable agriculture. Estimates indicate that the region needs between US$10 billion and US$29 billion annually to meet its climate targets.

However, many Caribbean nations face serious fiscal constraints.

“Many Caribbean nations are small island developing states (SIDS) with constrained budgets. Funding large-scale sustainable projects, such as port electrification and renewable energy installations, often requires international loans or grants,” Baptiste noted.

Public debt levels limit national capacity to fund green initiatives. Still, Baptiste believes that green finance represents a viable path forward.

“It is possible to finance a ‘Green Caribbean’, and various initiatives and mechanisms are being developed to support this transition. These include blended finance, green bonds, and impact investment vehicles tailored for Small Island Developing States (SIDS). The focus is on bridging the investment gap by making green projects more bankable and attracting private sector involvement,” he said.

Anton Edmunds, General Manager of the Caribbean Country Department at the Inter-American Development Bank (IDB), supports this outlook, noting that green financing can and should involve a combination of public, private, and international sources.

“Public development banks, governments, and multilateral organizations play a crucial role, particularly in the initial stages, while private sector involvement is essential for long-term sustainability,” Edmunds said.

He added that green finance has the power to reshape Caribbean economies.

“Green finance can significantly improve Caribbean economies by attracting investment into sustainable projects, reducing reliance on fossil fuels, and creating new economic opportunities. By embracing green finance, the Caribbean can build a more resilient, diversified, and environmentally sustainable future,” he explained.

Edmunds noted that the region is rich in natural capital, which, if properly managed, can be leveraged for transformative, inclusive development.

“Ecosystems such as coral reefs, among others, not only play an essential role in carbon absorption and water conservation, but also support the production of food, raw materials, and key resources for the livelihoods of the region’s population and economy,” he said.

Yet, the Caribbean remains highly vulnerable to climate impacts, ecosystem degradation, and pollution of air, water, and soil. These environmental threats carry serious socio-economic consequences, from food insecurity and public health challenges to slowed development.

“These phenomena have significant socioeconomic impacts, affecting livelihoods, food security, human health, and development. In this context, the IDB has been supporting governments through the Caribbean Development Bank, to help create a nexus between the nature, climate, waste, and energy portfolios through different policy instruments that integrate development and seek greater resource mobilization to address the triple planetary crisis,” Edmunds stated.

Green finance is increasingly being viewed not only as an environmental imperative but as a mechanism to accelerate broader national development goals.

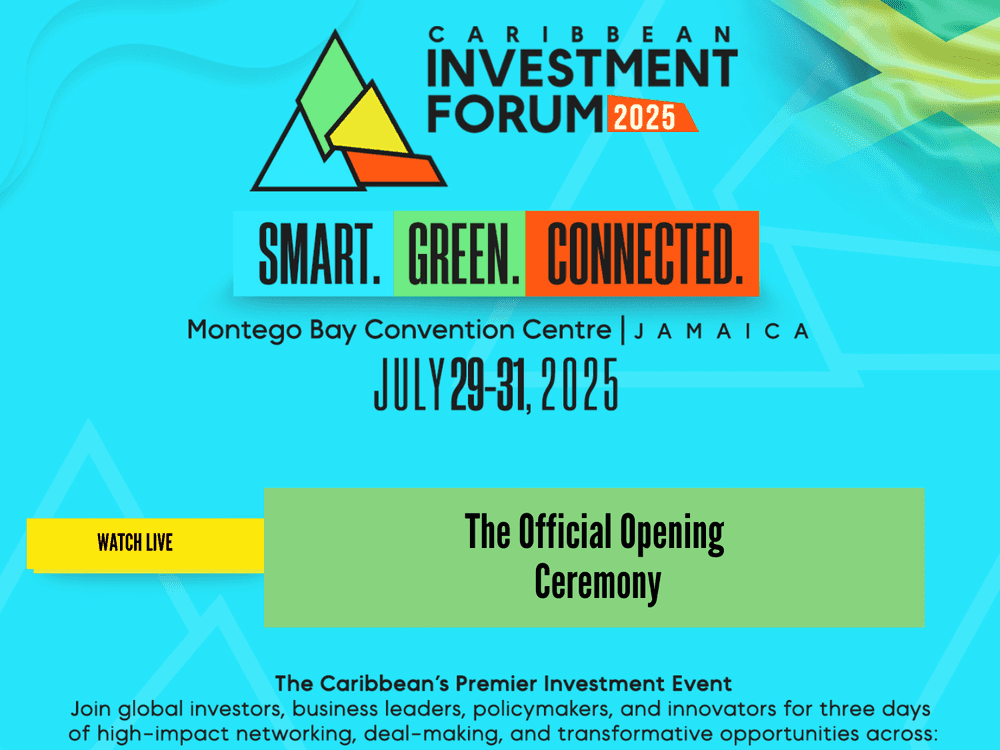

Baptiste and Edmunds agree that the upcoming Caribbean Investment Forum (CIF 2025) presents an opportunity to spotlight investment-ready projects and solutions that advance the region’s green transition.

CIF 2025 is hosted by the Caribbean Export Development Agency in collaboration with the Ministry of Industry, Investment & Commerce (MIIC), JAMPRO, the European Union Global Gateway, and the CARICOM Secretariat. Strategic partners include Republic Bank, the Inter-American Development Bank (IDB), and the Jamaica Special Economic Zone Authority (JSEZA).

Other confirmed speakers include David Mogollon, Head of Cooperation EU Delegation to Barbados, Eastern Caribbean States, Trinidad and Tobago, the OECS and CARICOM/CARIFORUM, Karen Yip Chuck, Group Vice President, Republic Financial Holdings Limited and Vice President, Republic Bank Limited, Gillian Charles-Gollop, Executive Director, & Head, Corporate Banking & Sustainable Finance, CIBC, Darryl White, Managing Director – Caribbean Region IDB Invest and Antonio H. Pinheiro Silveira, Vice President – Private Sector CAF Development Bank of Latin America and the Caribbean.